Weather Closure

Due to winter weather, we will be closing our Go Energy Tucker branch at 3 p.m. today (Tuesday) and re-opening Wednesday at 8 a.m.

Auto Loans

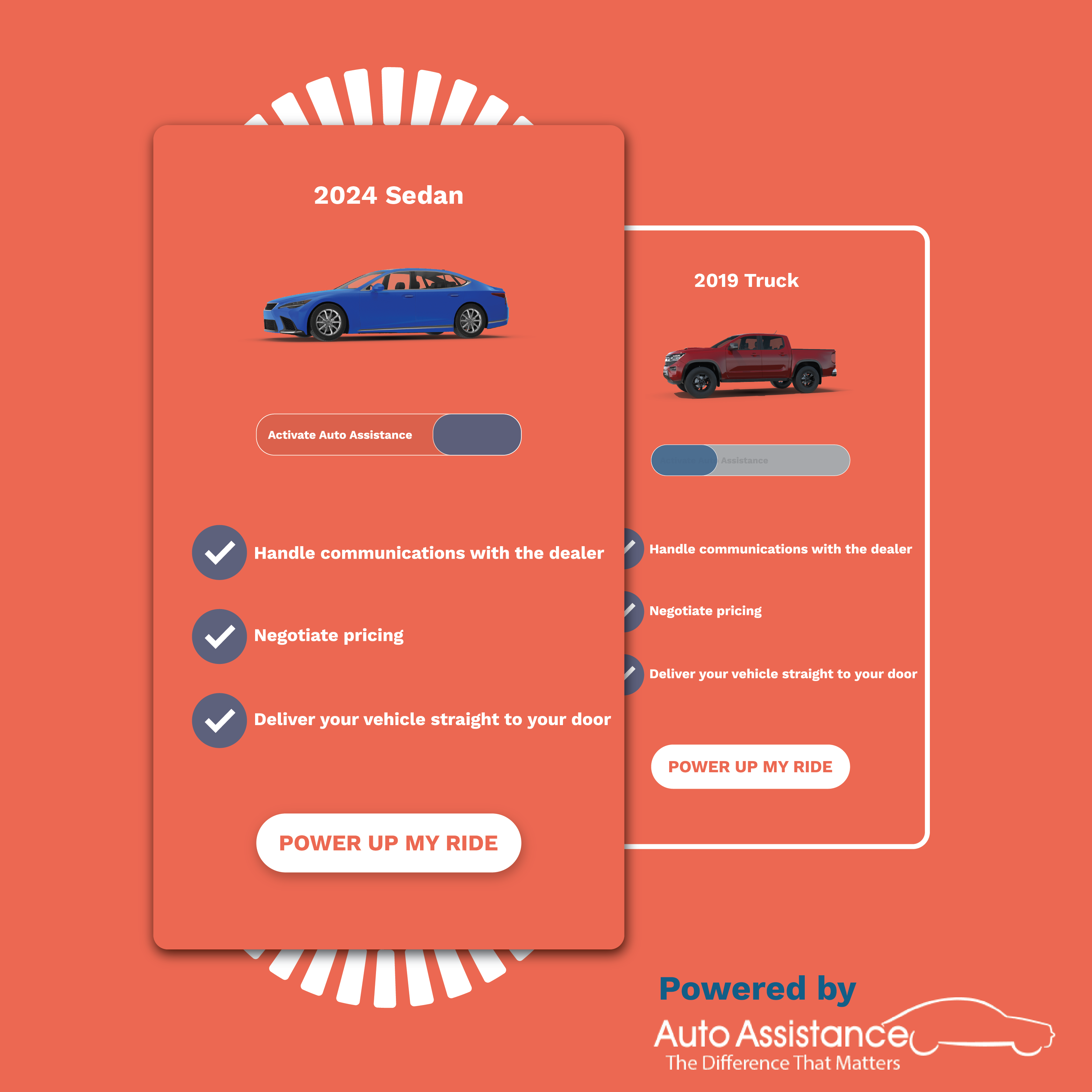

Auto & Vehicle Loans from Go Energy Credit Union

Dream car? Daily driver? We want to see you behind the wheel of your new ride! Obeying the posted limits, of course.

Auto Loans

Go Energy Credit Union has the vehicle financing to put you on the road. Shop smart and confident with a pre-approved loan. Then get a great rate and payments that fit your budget. We refinance, too!

Other Vehicle Loans

Let us get you and your vehicle off the road! Yes, off.

We finance other vehicles beyond cars. From lake to campground to field, we’ve got the loan to power your life. We are experts in boat, recreational vehicle, motorcycle, and tractor financing. So if you’re ready to play now or work now, and play later, we can help.

Questions About Auto Loans?

We’re standing by to give you the rate, term, and collateral information you need. Thinking about it at 3 a.m.? Send us a note, and we'll get back to you— after our first cup of coffee.

Auto Loan Links to Explore

Insurance

Auto Loan Extras

Make owning your new car as smooth as it is to drive it.

Accidents and breakdowns happen, but be prepared with GAP coverage (not jeans) and MBI. We can help and we’ll even tell you what those acronyms mean.

Guaranteed Auto Protection (GAP Coverage)

Here’s how GAP coverage works:

- You have a car.

- You have a car loan.

- You have an accident.

Luckily, you’re okay— but your car is a total loss. That’s not okay.

Mechanical Breakdown Insurance (MBI)

Just like the Men in Black (MiB) save the world from intergalactic threats, MBI can save you a whole lot of money on car repairs.

Life is unpredictable.

There is a wide range of unexpected events that could leave you and your family scrambling to pay monthly bills. That's why it is important you take action to safeguard your family against these types of events to help ensure loan payments can be made on time. That's where Go Energy Credit Union Debt Protection comes in.

Discounted Auto Rate*APR = Annual Percentage Rate. Equal opportunity lender. To qualify for the 25 basis point discount, borrower must establish automatic loan payments from a Go Energy Credit Union checking account within thirty (30) days of the loan funding date and to continue the automatic loan payment set forth above throughout the life of the loan. Failure to do so will result in a reversal of the loan discount.